Calculate my salary after tax

The interest and often the contributions are tax-deferred. Should I exercise my in-the-money stock options.

Salary Formula Calculate Salary Calculator Excel Template

Student loan pension contributions bonuses company car dividends Scottish tax and many more advanced features available in our tax calculator below.

. You will get approximately R5600 gross pay R110002167 X 11 ie before tax. This is a break-down of how your after tax take-home pay is calculated on your 50000 yearly income. After taking 12 tax from that 16775 we are left with 2013 of tax.

For the purposes of deduction of tax on salary payable in foreign. Advanced Tax Calculator Guide. I want to know the exempted amount of HRA from my salaryI am a Haryana govt employee.

I was trying to find out my net pay after tax for 7000000 Even I visit IRD two times but the way they were explaining in far complicated. Now i am get the salary Rs23760 and my deduction epf 12 and esi 175 and i have pancard. Given that the second tax bracket is 12 once we have taken the previously taxes 10275 away from 27050 we are left with a total taxable amount of 16775.

Convert my hourly wage to an equivalent annual salary. Florida residents do not need to pay sales taxes on intangible purchases like investments. Which includes 9000 of superannuation then your salary package is worth 109000 your gross income is 100000 your tax withheld would be around 26000.

Moreover as per the Income Tax Act 1961 it is mandatory for every taxpayer to provide Form 16 before the due date. I would like to learn more about Federal Tax and State Tax. You can then work out how much you can borrow for a mortgagehome loan.

John joined a bank recently where he earns a gross salary of 200000 annually. Convert my salary to an equivalent hourly wage. Click on Calculate to get your tax liability.

ICalculator MY Excellent Free. How is calculate my tds please guide me. 50000 After Tax Explained.

This needs to be added to your salary and then will be taxed at your marginal rate of tax. Every company has its own employment costs calculator to calculate how much spend on their salary pay based on job title job description and responsivity. In case your total taxable income after deductions doesnt exceed Rs 5 lakh you can claim rebate under Sec 87A of Rs 12500.

Self-assessment tax will be total tax payable minus taxes already paid ie. I would like to calculate my salary after tax. Calculate you Monthly salary after tax using the online Malaysia Tax Calculator updated with the 2022 income tax rates in Malaysia.

PensionIf you currently have a pension enter the amount that you pay into the pension on a regular basisThis can be entered in a percentage format eg. While filing for his income tax returns his accountant informed him that he is eligible for tax exemption worth 20000 and deductions worth 25000. You will also be able to see a comparison of your pre-budget and post-budget tax liability.

While income tax is the largest of the costs many others listed above are taken into account in the calculation. Press Calculate to see your salary after tax and take home breakdown - Tax made Simple. Now lets see more details about how weve gotten this monthly take-home sum of 3130 after extracting your tax and NI from.

4 or in a numeric format eg. Now calculate the total tax payable on such net taxable income. If you earn 50000 in a year you will take home 37554 leaving you with a net income of 3130 every month.

Form 16 provides the details of gross salary deductions exemptions and TDS for the purpose of computing tax payable and tax refundable. TDS TCS advance tax tax relief under section 87A9090A91 tax credit. The calculation of the tax-exempt portion on your compound pension annuity involves the Simplified Formula adjusted for the total tax-exempt amount allowed for the gradual pension.

July 26 2017 at 457 pm. Use our Income Tax Calculator to calculate your tax payable and net income. What is the future value of my employee stock options.

Calculate your net salary and find out exactly how much tax and national insurance you should pay to HMRC based on your income. Just enter your gross annual salary into the box and click Calculate - then well present you with an overview of your tax and net salary. Determine if sales taxes are charged on the sale.

The 111 tax-free percentage will be applied to 1795 to produce a tax-free amount of 19925 1795 x. Calculate your income tax social security and pension deductions in seconds. The Salary Calculator for US Salary Tax Calculator 202223 - Federal and State Tax Calculations with full payroll deductions tax credits and allowances for 2022 and 2021 with detailed updates and supporting tax tables.

Some tangible items such as groceries seeds fertilizer and prescription medicines are exempt from Florida sales tax. How will payroll adjustments affect my take-home pay. For example if you earn 109000 pa.

How much will my company bonus net after taxes. Now I can see the whole break down. Sales tax is only charged on purchases of tangible products or some services.

To calculate the self-assessment tax first calculate the net taxable income after giving into effect every deduction and exemption. Note When entering pension in a numeric format please use the same frequency as you used to enter your gross salary. By understanding how the Income-tax is calculating you can estimate your taxes based on your salary or income after the annual Union Budget is presented.

Tax rebate is a form of tax incentive provided by the government to individuals earning an income below a specified limit. Rebate under Sec 87A. How much does a GS 13 make in retirement.

What may my 401k be worth. Let us take the example of John to understand the calculation for the effective tax rate. Please use our SARS income tax calculator and enter the total leave plus salary for the month to see amount you will clear.

Nonprofit organizations have similar plans. The advanced features of the Tax Form Calculator provide more control of expense deductions and tax credits allowing you to produce an estimation of your annual tax return so you can manage your tax withholdings. If you specified an annual gross salary the amount entered in the.

How To Calculate Net Pay Step By Step Example

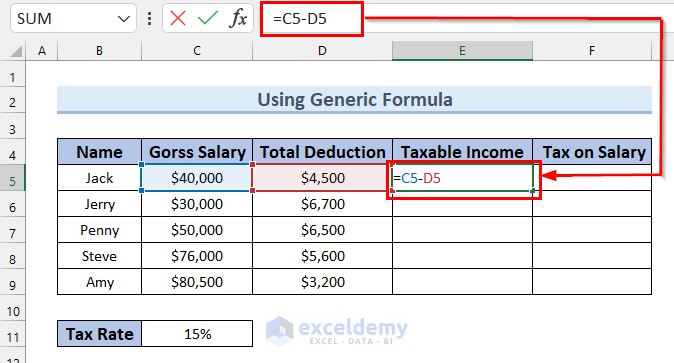

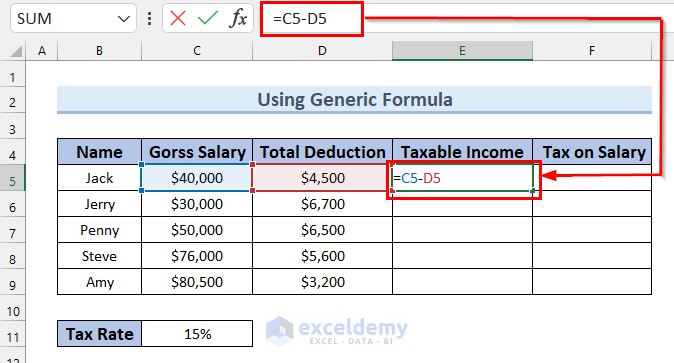

Taxable Income Formula Examples How To Calculate Taxable Income

How To Calculate Foreigner S Income Tax In China China Admissions

How To Calculate Income Tax In Excel

Salary Formula Calculate Salary Calculator Excel Template

Tax Calculator Estimate Your Income Tax For 2022 Free

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Calculate Income Tax On Salary With Example

Income Tax Formula Excel University

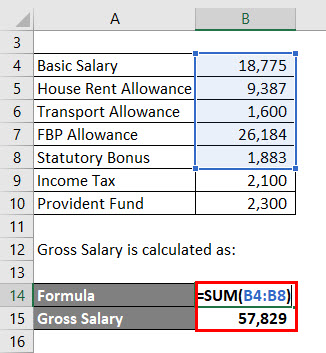

How To Calculate Gross Income Per Month

How To Calculate Income Tax In Excel

Here S How Much Money You Take Home From A 75 000 Salary

How To Calculate Income Tax On Salary With Example In Excel

How To Calculate Income Tax In Excel

How To Calculate Income Tax On Salary With Example

Excel Formula Income Tax Bracket Calculation Exceljet